Online Master of Business Analytics

HSE University

Key Information

Campus location

Moscow, Russia

Languages

English

Study format

Distance Learning

Duration

2 years

Pace

Full time

Tuition fees

RUB 640,000 / per year **

Application deadline

Request info *

Earliest start date

Request info

* online applications are accepted for preliminary selection; online candidate interviews will be held with programmes; you have to upload your portfolio to the personal online account before August 10

** 1 280 000 RUB for the entire period of study

Scholarships

Explore scholarship opportunities to help fund your studies

Introduction

Online program on Coursera.

Earn an MSc degree in Finance with a major in Business Analytics and become a finance leader today.

Gain practical experience in new career tracks and enjoy access to valuable career resources that will enable you to be successful in the world of finance.

About

Our Master of Business Analytics program is among the first in the world to offer to global audiences cutting-edge concepts and methods of business analytics and strategic reporting that are aligned with the new principles of regenerative economy and finance, inclusive capitalism, and enhanced value creation for financial and non-financial stakeholders.

The program offers new competencies that employers all over the world seek to compete in the knowledge economy and to achieve the sustainability goals of countries and businesses in uncertain times such as these.

The curriculum has a global scope and captures new trends in value creation analysis involving the non-financial capital of a company, their disclosure, as well as new auditing and assurance strategies.

Students of the program learn:

- How to develop stakeholder’s value creation frameworks for business analysis and reporting to navigate company’s decisions;

- How to determine what drives financial performance and the ability of a business to create and capture value for financial and non-financial stakeholders;

- How strategic reporting secures the connectivity between non-financial capitals, sustainability of the business, and future financial performance;

- How the non-financial capitals change audit frameworks and assurance strategies;

- How integrated approach to multiple capital analytics involves integrated thinking into top management teams and board of directors work.

The curriculum of the Master of Business Analytics program focuses on the following topics within a global scope: new trends in value creation analysis involving non-financial capitals of a company, their disclosure, as well as auditing and assurance strategies.

The Tasks of the Future Professional — the Business Analyst

The Master's program is aimed at new groups of competencies in areas that, at first glance, belong to traditional professional tracks, such as financial management, accounting, and reporting. But we have highlighted in the new training lines for new roles, corresponding to new international practices. Our graduates will be prepared for several promising career paths.

In financial management, for example, the central challenge is to have a methodology for analysis that integrates financial and non-financial capital and aims to add value to the business, taking into account the interests of different stakeholder groups over the long term. The peak of such a career in the near future is the chief value officer (CVO), which will replace the chief financial officer (CFO). This trend in the profession also requires a new approach to budgeting and modeling in order to achieve sustainable company value in the long run.

A new position is taking shape — the ESG director — who provides a new quality of management of the company's different capitals to achieve specific environmental, social development, and board role targets. Innovations are also emerging in risk management: integrated risk management concepts and tools are being developed, taking into account risk factors hidden in non-financial capitals and modeling them. The second group of changes in the professional tracks is related to accounting and reporting. Different forms of non-financial reporting are developing rapidly. It is not just a matter of adding more sections to companies' reporting, but a new quality of reporting. It needs to become holistic, integrating non-financial capitals, their risks, and their impact on financial results, both current and future. The third area of change in the finance profession is innovation in risk management. The concepts and tools of integrated risk management, taking into account risk factors of non-financial capitals and their modeling, risk-based planning is being formed.

Objectives

The Master of Business Analytics is an online Master's program that is anchored in the mainstream view of business on the challenges and ways of turning business models around to achieve UN Sustainable Development Goals; challenges that business itself has articulated in global economic forums and high-level discussion platforms as stakeholder capitalism. This is called a set of radically new concepts, first, because they require new layers of data focusing on the non-financial resources of companies that depend on non-financial stakeholders (human, customer, structural, digital, and natural capital). Second, new analytical developments on the inclusion of non-financial capital in the assessment and projection of future financial performance. Therefore, financial education now faces the challenges of anticipatory training for new professional tracks. That is why we have developed a new Master's degree concept and implemented it in the Master of Business Analytics program.

Features

What makes the program different is the originality of its content. It is centered upon the new professional tracks of the near future and includes two new specializations: Value-Based Business Analytics and Strategic Business Reporting. In addition, the Programme has a global focus. We have created a new format for working with students — Virtual Project Labs — with international experts from Europe and Asia as presenters. In direct dialogue with the students, the experts will not only summarise their experience in solving a range of new business analytics problems but will also formulate new ones. After all, we are just now at a kind of tipping point in knowledge in this area, in the professional skills that are the future. This is why international colleagues from our professional network will share a variety of perspectives on these emerging trends. In addition, we have introduced project-based seminars involving business experts from these growing new tracks in the financial professions before our eyes. These workshops become tools for organizing creative work by small teams of students on project themes within specializations. The modern world is dictating new formats for delivering education. In an environment of uncertainty and multitasking, online education is becoming increasingly important thanks to the flexible ‘learn from anywhere and with a flexible schedule’ format and the well-established set of digital tools for organizing the educational process that our partners in Coursera are implementing.

The Programme is implemented in cooperation with the professional organizations, ACCA, AICPA-CIMA, and IMA. The Master of Business Analytics program has 40 paid places for applicants from Russia and 7 for foreign nationals. To apply, applicants must submit a portfolio to the Admissions Committee. Russian citizens must also take an English language proficiency exam or submit IELTS, TOEFL, or CAE certificates.

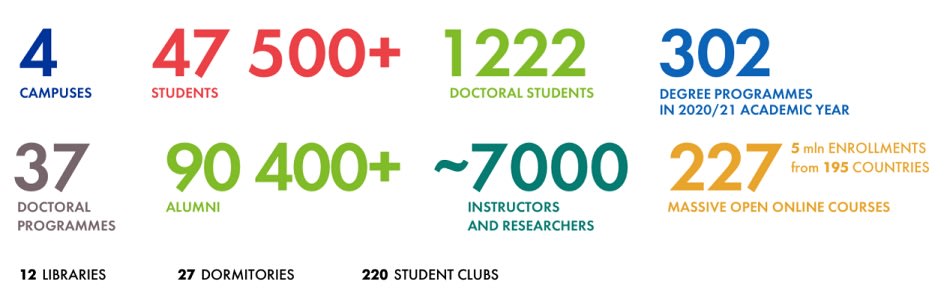

Facts and figures

HSE University at a Glance

Gallery

Admissions

Scholarships and Funding

Curriculum

We offer you core courses to build a sound background in finance and accounting and their applications and applied specializations with 5-6 electives, 2 applied research projects based on real-world problems under supervision by industry experts, and Virtual Labs with international experts. You will have access to global databases (Bloomberg, Thomson Reuters, Capital IQ, Van Dijk) and to worldwide finance and accounting journals and books for developing your solutions to cases, projects, and course assignments.

Program Outline

Foundations

- Theory of Finance covers the principles and fundamental theories of valuation of various types of primary and derivative financial assets. It also discusses the role of information flows in asset pricing.

- Macroeconomics aims to develop a model-based way of ‘aggregate model-based thinking’ and prepares students to apply relevant macroeconomic tools in their further studies and professional career.

- Econometrics focuses on the estimation and identification of regression models. The course aims to provide you with knowledge on the fundamentals of econometrics and its application, knowledge, and proficiency on the use of statistical package STATA for econometric analysis, practice in conducting data analysis, and application of econometric tools in research and analytics.

The Core

- Financial Markets and Financial Instruments covers financial intermediation, market infrastructure, and regulation, recent driving forces of the financial crisis, and bubbles. It is focused on the various financial instruments including traditional (stocks, bonds, and derivatives), alternative types of financing (structured finance, collateralized debt obligations), and digital finance.

- Сorporate Finance develops a conceptual risk-return framework to analyze the broad area of corporate decisions (investing, financing, payout, merger&acquisitions, business restructuring, and types of the financial architecture of the firms). It provides the prevailing empirical evidence for managerial and investor motives behind the decisions, and how they influence corporate performance in developed and emerging capital markets. To enlarge your understanding of existing trade-offs, you will be exposed to the role of behavioral biases of top managers (CEOs) in decisions and their performance impact.

- International Financial Reporting Standards 1 covers financial accounting concepts for major types of assets, liabilities, and equity and major formats of financial statements. Special emphasis is given to the application of financial reports to business analysis.

- International Financial Reporting Standards 2 covers significant issues and tasks faced by professional financial analysts and accountants. You will be able to deal with special items (e.g. intra-companies’ transactions and unrealized gains) and to prepare basic consolidated financial statements.

- Valuation and Value-Based Management equips you with a thorough knowledge of methods to identify the value of the business with the special emphasis on knowledge-intensive firms for making strategic deals by buying and selling companies and managing a business. It develops value-based thinking and value-based metrics for performance analysis, and strategic decision-making backed by value creation criteria and operational value planning.

- Public Non-Finance Reporting examines the role of sustainability accounting, non-financial capital accounting, disclosure, and reporting. It is focused on integrated thinking in preparing company reports and how to secure the connectivity between financial and non-financial data to ensure a better understanding of value creation for a wide range of stakeholders. Special attention is paid to the materiality of non-financial capital disclosure and determinants for the supply and demand for non-financial reporting.

- Strategic Managerial Accounting develops techniques and skills in generating quantitative and qualitative information for strategic planning, decision making, performance evaluation, and control. It focuses on various methods of budgeting to ensure the relationship between short-term and long-term performance goals.

- Strategic Management provides students with a framework for understanding new trends in developing and implementing successful corporate strategies to gain competitive advantage and agile organization. It develops skills in identifying effective business models to leverage the drivers for stakeholder value creation (“extended shareholder value”), shared values, and how to create a sustainable company that is ethically sound and addresses economic, environmental, and social goals.

- Research Methods combines different methods in Business Analytics including strategic finance, business reporting, data driven methods and applications.

Elective Courses

Electives (5 or 6 out of 11)

- Integrated Risk Management develops skills in multi-capitals risk management and integrating non-financial and financial drivers of risk in strategic management and business planning to meet new levels of exposure to risks (including fundamentally new risks). To survive in growing turbulence and increased volatility, companies must adopt the new generation of risk management systems, namely risk intelligent enterprise. The course provides techniques to foster decision-making in the “value-risk” coordinates and to drive the resilience of the firm and enhanced financial results.

- Corporate Governance and Compliance (with an industry expert): This course examines key areas of corporate governance and compliance, such as shareholders’ role and responsibilities, board’s performance, corporate transparency, and disclosure, ESG risks mitigation, investor relations, and compliance system organization. During this course, you will also be able to practice your knowledge in case studies.

- Digital Capital: Applications in Finance (with an industry expert) explores the role of digital assets and technologies among the value drivers of a company. It includes analysis of digital transformation, platform business models and strategies, their impact over created shared values and inclusive capitalism, and how they impact the individual investors and direct appeal to them. The course provides insights into the role of fintech, new financial ecosystems, and how they bring new challenges for digital assets management and accounting, risk management, and value creation.

- Behavioral Finance: Applications for Business Analytics

- Sustainable Finance reviews the key concepts and sustainability-oriented financial instruments, motivations behind the increased awareness of ESG by investors and the public, discussions on materiality, and approaches to incorporating ESG in the investment process. It involves practical cases focused on ESG reporting roles in investment decision-making and the ways to integrate ESG data in investment decisions. We discuss new requirements and toolkits for incorporating ESG factors in investment analysis.

- Special Topics in Accounting (with an industry expert)

- Auditing and Assurance Strategies: The course focuses on the advanced study of professional auditing standards and the ethical responsibilities of auditors. It is aimed at providing knowledge on audit risk and materiality concepts, as well as risk assessment for the purposes of internal control over cash receipts and the payment cycle.

- Taxation and Tax Planning (with an industry expert) examines the basic principles of the tax system, methods of internal (within the Russian Federation) and cross-border tax planning, double taxation, and how it can be eliminated under different conventions. It discusses the problems of permanent establishment within the US, OECD, UN Model Tax Conventions, and fiscal unity within foreign and Russian tax legislations. Special emphasis is made on the applications application of the transfer pricing rules, Base Erosion and Profit Shifting initiatives, tax monitoring, and tax ruling.

- Financial Modelling (with an industry expert) explores the best practices according to the existing modeling guidelines. You will learn how to build a financial model, how to create a system of Pro Forma financial statements, and to forecast the changes in the firm’s future cash flows under different scenarios. It discusses. It how to define internal and external inputs and how to incorporate industry and macro data. Special focus is made on the use of non-financial data in forecasting future financial measures and pro forma statements.

- Forensic Accounting (with an industry expert) is designed to ensure professional competence in fraud detection. You will examine the causes of fraud and understand the framework and related methodologies and tools. The course also discusses the specific procedures for detecting fraud in emerging technologies such as e-commerce, blockchain, and cryptocurrency circulation and explains the new types of fraudulent behavior such as cybercrime and social engineering. We will also analyze the ways to build effective compliance and internal control via ethical organizational culture.

- Performance Management: covers the short-term financial management functions and responsibilities typically assigned to the Operational and Treasury Departments. You will learn how short-term financial decisions are made by financial managers in their business practice and how they are adjusted to industry specifics. You will examine how to provide in-depth coverage of credit management, short-term investment, and borrowing, how to choose and manage banking relationships, and how to integrate short-term financial solutions into a cash flow schedule. You will learn how working capital management roles contribute to long-term value creation and stakeholder value management in a company.

Rankings

HSE University’s standing, as of 2020, in numbers:

3rdHSE University ranks third in Russia (after Moscow State University and St. Petersburg State University) in terms of total number of positions (43) in subject and faculty world rankings; | 2ndHSE University places second (after Moscow State University) for number of positions in the Top-100; |

>50%In more than half of its offered subject areas (24), HSE University ranks first among all Russian academic institutions; | 9In nine subject areas, HSE University is the only Russian institution to be represented in the global rankings; | 5HSE University entered the rankings in five subject areas for the first time this year. |

Ranking «QS World University Rankings», 2020/2021

| HSE in the World/Europe | HSE in Russia |

| 298 | 7 |

QS – Top 50 Under 50, 2020

| HSE in the World/Europe | HSE in Russia |

| 31 | 1 |

Ranking «Academic Ranking of World Universities», 2020

| HSE in the World/Europe | HSE in Russia |

| 801–900 | 7–8 |

THE World University Rankings, 2020/2021

| HSE in the World/Europe | HSE in Russia |

| 251–300 | 3 |

THE Young University Rankings, 2021

| HSE in the World/Europe | HSE in Russia |

| 57 | 1 |

Ranking «THE World Reputation Rankings», 2020

| HSE in the World/Europe | HSE in Russia |

| 151-175 | 5 |

Ranking «U.S.News & World Report Best Global Universities», 2020/2021

| HSE in the World/Europe | HSE in Russia |

| 547 | 7 |

Ranking «Three University Missions», 2020

| HSE in the World/Europe | HSE in Russia |

| 120 | 4 |

Program Outcome

What will I gain from the program?

The program equips students with practical frameworks for:

- Identifying the drivers of value creation of companies in different industries to enhance business sustainability;

- Creating value-based performance metrics for different business units within a company;

- Financial modeling of a company’s value and projects under various scenarios to achieve sustainability goals;

- Creating new integrated risk management systems for a company to meet new challenges of the regenerative economy;

- Identifying and evaluating the relative performance of non-financial capitals, particularly human capital, relational or client capital, organizational capital and their contributions to value creation and financial performance;

- Meaningful measurement and disclosure of the value drivers of business to investors and all other stakeholders representing the economy, society, and the environment.

Career Opportunities

Graduates will be prepared for careers in:

- Business analytics for financial management

Includes a variety of functions within the companies, investment banks, and investment funds to fit regenerative finance framework and sustainability goals: value-based management; investor relations management; valuation and value creation analysis; intellectual capital valuation and performance metrics; performance management and value-based performance indicators for internal business units; financial modeling and long term planning derived from multiple capitals performance; sustainable finance instruments; risk-oriented budgeting; integrated risk management systems and indicators. - Business analytics for value-based compliance

Assumes application of the best practices in stakeholder value creation, its measurement, and management, development of metrics and internal plans to comply with responsible and ethical practices, their implementation for different industrial profiles and types of companies; integration of non-financial capitals into risk analysis; implementation of integrated risk management policies and advice to boards of directors on risk measurement practices; internal auditing strategy and identification of financial fraud; forensic accounting system development. - Business analytics for strategic consulting

Assumes application of the best practices in assessing the impact of corporate strategies over stakeholder value creation; key performance indicators for stakeholder value-added; indicators for non-financial capital’s management; adjustments to remuneration policies to motivate for stakeholders’ value creation; integration of non-financial data into financial planning and company’s and industry forecasts for management and boards of directors. - Accounting and reporting (financial and non-financial)

Deals with the preparation of financial reports (IFRS) and Pro Forma statements; preparation of non-financial reports including ESG reporting, integrated reporting, value reporting guidelines; development of managerial accounting systems for the needs of stakeholder value-added management; internal control; assurance of non-financial data and non-financial reports.

Our off-line graduates from Degree programmes in Finance are employed by the following companies